Negotiating with Your Insurance Company After a Claim: A Tech Expert’s Guide

Dealing with insurance claims can feel like navigating a complex algorithm. But what if I told you there’s a systematic approach, much like optimizing a software program, to ensure you get the fairest settlement? As a full-stack software developer with over five years of experience at New Way Solution Private Limited (USA), I’ve learned to approach problems with a structured, data-driven mindset. This same approach can significantly improve your chances of a successful insurance claim negotiation.

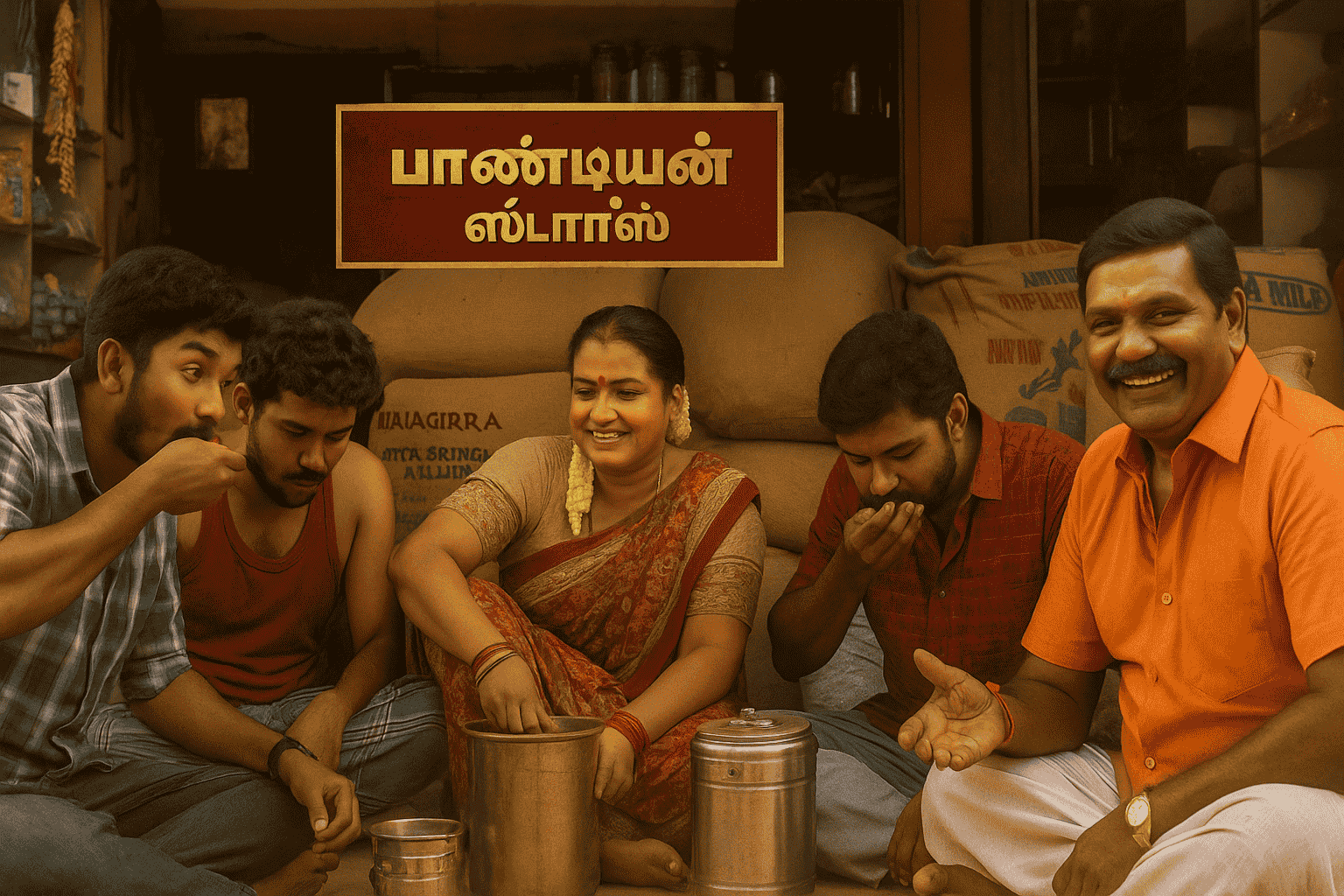

📺 Watch: Pandian Stores-10-09-2025

Video: Pandian Stores-10-09-2025

Understanding Your Policy: The First Line of Code

Before you even think about negotiation, thoroughly review your policy. What are the specific coverages? What are the exclusions? Understanding the fine print is crucial. Think of this as debugging your code – identifying potential errors (unclear clauses) before they cause problems.

Document Everything: Building Your Case

This is where the real work begins. Gather all relevant documentation: photos, videos, police reports, repair estimates, medical bills, etc. The more comprehensive your documentation, the stronger your case. Think of this as creating robust unit tests for your software – ensuring every aspect is thoroughly tested and validated.

Negotiating Strategies: Optimizing for the Best Outcome

Now comes the negotiation phase. Remember, this isn’t a battle; it’s a discussion. Approach it strategically. Consider these points:

- Be polite but firm: Maintain a professional demeanor. Clear, concise communication is key.

- Know your worth: Research comparable claims and settlements. This data-driven approach helps you justify your position.

- Focus on the facts: Avoid emotional arguments. Let the documentation speak for itself.

- Be prepared to compromise: Negotiation involves give-and-take. Finding a mutually agreeable solution is the goal.

Leveraging Technology for a Stronger Case

In today’s digital age, technology can be a powerful tool. Consider using video evidence to support your claim. High-quality videos can be compelling evidence, especially in cases involving property damage. Think of it as using AI-powered analytics to enhance your case.

Common Mistakes to Avoid: Debugging Your Negotiation

Many people make mistakes during insurance claim negotiations. Avoid these pitfalls:

- Not documenting thoroughly: A lack of evidence weakens your position.

- Being overly emotional: Maintain a calm, professional demeanor.

- Accepting the first offer: Always explore options for a better settlement.

- Not understanding your policy: Knowing your policy inside and out is essential.

Frequently Asked Questions (FAQ)

Q: What if my insurance company denies my claim?

A: If your claim is denied, carefully review the reasons provided. Gather additional evidence if necessary and consider appealing the decision or seeking legal counsel.

Q: How long does the negotiation process typically take?

A: The timeline varies depending on the complexity of the claim and the insurance company’s processes. It can range from a few weeks to several months.

Conclusion: The Code to a Successful Settlement

Negotiating with your insurance company doesn’t have to be daunting. By approaching the process systematically, documenting thoroughly, and understanding your policy, you can significantly improve your chances of a fair settlement. Remember, just like optimizing software, a well-structured approach yields the best results. This structured approach, honed through my experience in software development, can be applied to any challenging situation, offering a path to a successful outcome.

Disclaimer: This article provides general information and should not be considered legal advice. Consult with a legal professional for specific guidance regarding your insurance claim.

📚 References & Further Reading

For more information and in-depth analysis, here are some authoritative sources:

Disclaimer: External links are provided for informational purposes and open in new tabs.