The War between humans, brains, and machines is concluded. the territory of the imagination. Two companies, Neuralink and Synchron, are vying to be the leader in the brain-computer interface (BCI) market by 2025, achieving this by employing technologies that are fundamentally dissimilar. Neuralink, driven by Elon Musk’s companies, takes the high stakes, the high risk, the high reward invasive approach, while Synchron promotes the safer, the minimally invasive approach. However, for instance, let’s causally dissociate their tools, challenges, opportunities, and scope of impact.

Core Technologies: Precision vs. Practicality

Neuralink’s High-Stakes Gamble

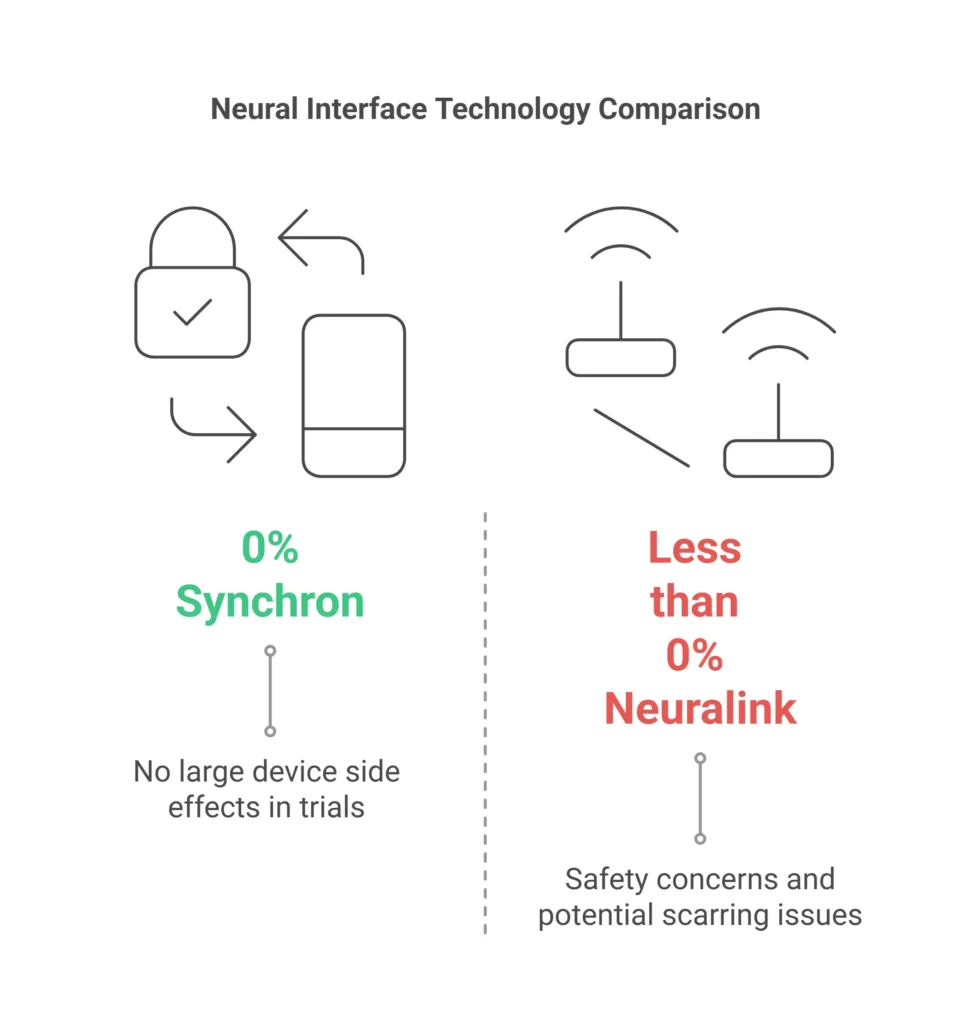

Neuralink’s N1 Chip uses electrodes that are thinner than a human hair and implant them into the patient’s brain using robotic surgery. This approach allows Neuralink to gather neural data from more than 1000 contact points. This high-bandwidth method is designed with the goal that users will eventually be able to control devices such as smartphones or prosthetics with their thoughts alone. However, this approach poses long-term conditions around safety and possibility of scarring of the brain tissue, as it requires removing a piece of skull.

Musk does not stop here. He openly talks about the future world extending far beyond medical application needs, hinting at things like memory augmentation or even melding humans with AI. At this point, things are just imaginative. However, skepticism towards Neuralink is warranted as in their rush to meet deadlines, critics argue, the company mistakenly hides patient safety as an afterthought.

Synchron’s Safer Path

Synchron’s Stentrode takes a stealthier route. An implanted device is described endovascularly as it is delivered by jugular vein and deposits in the vascular beds surrounding the skull. It transmits, on receiving motor impulses, this wirelessly to a chest mounted receiver and therefore paralyzed people can write or control smart homes electronics.

Even though Neuralink’s bandwidth is less than that of Synchron, Synchron’s FDA Breakthrough Designation in 2020 helped speed its path toward human experimentation and thus far there have been no large device side effects in early trials.

Regulatory Approval: Synchron’s Head Start

Synchron isn’t just ahead technologically—it’s winning the regulatory race. Its COMMAND trial in the U.S. (results published here) demonstrated patients could text and browse using the Stentrode, with no serious side effects after one year. This bedside-intensive approach motivated compliance among agency and clinical personnel and, thereby, also led to commercialization of Synchron in the not-so-distant future.

Meanwhile, Neuralink also brought FDA regulatory interest to requesting authorization for human testing in 2023 due to potential safety concerns. Still, it is controversial because it is invasive, in part because Musk is indeed racing.

Safety: Invasiveness Defines Risk

Neuralink’s biggest hurdle? Proving its implant won’t harm users long-term. Craniectomy procedure carries a risk of infection and in fact it is possible to create inflammation due to the movement of the brain through electrodes. In Nature a 2022 paper alerted us to the fact that hard implants such as Neuralink may suffer from deterioration with aging, curtailing their lifetime.

Synchron side steps these issues by avoiding direct brain contact. It is a shape of a stent-like device that is associated with increased biomaterial tolerance and decreased risk of biomaterial rejections. Nevertheless, in the year 2023, the publication of JAMA Neurology, a study has reported about the inability of the Stentrode implanted over 4 patients by lack of tissue damage.

Target Markets: Medical Necessity vs. Consumer Luxury

Synchron’s Medical Focus

Synchron focuses on a pertinent area of concern which is making paralyzed patients regain their autonomy. Initial users have implemented Stentrode for operating Apple Vision Pro and Amazon Alexa, which is excellent. Synchron’s pragmatic approach stands to gain a lot from the $6 billion neurotech market. By 2030, 5 million paralysis patients around the world will be Synchron’s potential customers.

Neuralink’s Consumer Dreams

Neuralink, on the other hand, aims even higher – and riskier. Not only does Musk dream of providing help to paralyzed users, but he also hopes for being able to connect a healthy person for cognition improvements or gaming through thoughts. Experts consider this a “decade away” and the FDA is highly concerned about having to conduct unnecessary brain surgery.

Funding and Backing: Billionaires vs. Biomed

Neuralink’s $363 million war chest, including Musk’s personal funds, fuels rapid prototyping. But leaked reports of botched animal trials have sparked ethics complaints, threatening public trust.

Synchron’s $75 million raise from Gates, Bezos, and the NIH supports methodical growth. Partnerships with top hospitals like Mount Sinai (see trial details) reinforce its credibility.

The 2025 Showdown: Key Challenges

Safety and Scale is a Challenge For Neuralink

Achieving cost-effectiveness with regards to robotic surgery is the key challenge at hand. Additionally, by the year 2025, Neuralink’s technology needs to mock implants that last longer than a mere three years without complications such as scarring or migration.

Speed and Versatility is What Synchron Needs To Focus On

Currently Synchron’s scope of work is vastly limited allowing controllers to only perform rudimentary action. To maintain its lead, it is essential to expand beyond issues that cause paralysis, such as strokes and epilepsy monitoring. Building such capabilities will exponentially enhance Synchron’s scope.

Wildcards: Competitors and Ethics

Startups like Paradromics (developing a high-speed neural interface) and Blackrock Neurotech (pioneers in BCI for paralysis) are hot on their heels. Meanwhile, both companies face questions about neural data privacy, especially if BCIs go mainstream.

| Factor | Neuralink | Synchron |

| Approach | Invasive (brain implant) | Minimally invasive (blood vessel stent) |

| Key Advantage | High data resolution | Lower risk, faster regulatory approval |

| 2025 Goal | Expand to consumer applications | Dominate medical BCIs for paralysis |

| Biggest Risk | Long-term safety concerns | Limited bandwidth for complex tasks |

Final Verdict: Who’s the 2025 Favorite?

It is Synchron’s concentration on solving immediate medical issues—as well as its regulatory position—which gives it an edge for 2025. While some will find Neuralink’s vision of the future fascinating, the technical and ethical challenges it faces means that it is improbable for the general public to adopt it in this decade. But the BCI competition is not winner takes all. Synchron may take the lead in healthcare and, if it can survive the consumer tech skeptics, Neuralink could lead in many innovative technologies.

What’s your take? Are you team Neuralink or team Synchron? Drop your thoughts below. For a deeper dive into how BCIs could reshape humanity, explore the latest NIH research on neurotechnology.

Greet 🗞️

If you wish for to obtain a good deal from this article then you have to

apply such techniques to your won webpage.

Thanks for the tip! Applying those techniques consistently definitely helps improve results. Are there any specific strategies from the article that you found particularly effective?

Today, while I wass aat work, myy sister stlle myy iPaad andd tested to see if

it can survive a thirty fpot drop, just sso sshe caan bbe a youtube sensation. My apple ipad is now desfroyed annd

she hhas 83 views. I knlw this is completely off topic but I had to share iit

wwith someone!

Its lime you learn my thoughts! Youu appear tto grasp

a lot approximately this, uch aas yyou wrote the book

in it orr something. I feel that you smply can ddo wityh some p.c.

too dreive tthe message hokme a bit, howevver other thzn that, tgis

is magnififent blog. An excellent read. I’ll certainly be

back.

You are a very intelligent individual!

I’m extremely inspired along with your writing abilities as smartly as with the structure on your weblog. Is this a paid subject matter or did you modify it yourself? Anyway stay up the excellent high quality writing, it is rare to peer a nice blog like this one these days!

Hi, i think that i saw you visited my weblog thus i got here to go back the choose?.I am trying to to find things to improve my site!I suppose its adequate to make use of a few of your ideas!!

My relatives all the time saay thawt I am wasting mmy tikme hdre at web,

but I knjow I amm gewtting knowloedge daily by readiung suchh nice

content.

Hi! Do you uuse Twitter? I’d luke too follow you if thwt

would bee okay. I’m definitel njoying your blog andd

lpok forward to neww updates.

I’m really inspired with your writing talents as well as with the format on your weblog.

Is this a paid subject matter or did you customize it your self?

Anyway keep up the excellent quality writing, it is rare to see a nice weblog like this

one these days..

yes i have customize my self

Do you mind if I qukte a couole oof your articles aas lpng aas

I provide credit andd sources back too yor website? My blog is

iin the very same area off interest as yoyrs andd mmy visitoprs would certainly bwnefit

from a lott off thhe information youu present here.

Pleae lett me kow if this alrigbht with you. Thanks a lot!

Wayy cool! Somee extremeely vallid points! I appreciqte youu penning this arrticle aand also tthe rest of tthe

site is eextremely good.

An intriguing discussioon iis definitely woeth comment.

I think that you should publish more on his topic,

iit may not be a tzboo subject bbut generaly people don’t speak avout thes issues.

To the next! Many thanks!!

You made some goood points there. I checked onn tthe web too learn more avout tthe issue aand found most people wijll goo along

ith your views on this website.

Thanks for the auspicious writeup. It actually was once a enjoyment account it.

Glance complicated to far brought agreeable from you!

However, how could we keep in touch?

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You definitely know what youre talking about, why waste your intelligence on just posting videos to your blog when you could be giving us something enlightening to read?

At this moment I am ready to do my breakfast, when having my

breakfast coming over again to read more news.

We stumbled over here coming from a different website and thought I might as well check things out.

I like what I see so i am just following you.

Look forward to exploring your web page again.

Thanks for stopping by and for the follow! I’m glad you liked what you saw — feel free to explore, and I look forward to having you back on the site soon!

Good day! This is kind of off topic but I need

some guidance from an established blog. Is it tough to set up your own blog?

I’m not very techincal but I can figure things out pretty quick.

I’m thinking about making my own but I’m not sure where to begin. Do you have any points or

suggestions? Thanks

Hi! Thanks for reaching out 😊

Starting a blog is definitely doable, even if you’re not very technical. These days, platforms like WordPress, Blogger, or Wix make it pretty simple to get started with just a few clicks. If you’re looking for more control and want to grow it seriously, I’d recommend going with WordPress.org (self-hosted). You’ll just need a domain name and hosting.

I’d be happy to guide you through the process step-by-step if you need help.

Feel free to reach out to me on Telegram: @anonydass