The tech investment landscape keeps on evolving with new promising companies in many different niches. “Nlink” is one of the hottest Ethereum opportunities that have been gaining the most interest from investors. So what is Nlink exactly, and is it a major play in the current tech market?

Given these three closest hits, we’ve done our homework and based on the results there are three very broad possibilities of what the company behind the name “Nlink” could be: Neuralink (Elon Musk’s brain-interface company), a cryptocurrency token (NLINK), and Blink Charging (BLNK), an electric vehicle charging infrastructure

Understanding Brain-Computer Interfaces (BCIs)

It is a pathbreaking technology that makes direct connection between the brain and external devices. Having been a developer dealing with emerging tech over the last 5 years, I’ve seen the subject evolve exponentially.

Neuralink, which Elon Musk co-founded in 2016, is developing state-of-the-art brain-machine interfaces that straddle neuroscience and artificial intelligence.

A Bold Step In The Right DirectionNeuralink is focused on developing implantable BCIs that first and foremost address neurological conditions over the long term to allow interaction between human intelligence and artificial intelligence.

The entire brain-computer interface market could potentially be worth over US$1.6 billion by 2045, according to IDTechEx, a significant sign of long-term growth in this sector.

Investment Options in the Nlink Space

Neuralink: Private Innovation in Neurotechnology

Neuralink is still a private entity with great investor interest thus retail investors cannot invest directly into its stock. The company’s technology is focused on solving neurological conditions at first, but has much wider implications for human-computer interaction.

That places Neuralink in the realm of “deep tech” that tends to draw large amounts of venture capital even with prolonged commercialization efforts. For anyone looking to invest in this space, it may be necessary to wait until we see a potential future public offering.

NLINK Cryptocurrency Token

According to whale alert, the Neuralink cryptocurrency token (NLINK) was created on the Binance Coin Blockchain and has variables that are considered to be minimal. Real-time value is near insignificance ($0.000000), but several price predictors aim for percentage increase from this infinitesimal base level.

Trading volumes are also massively low, with NLINK being traded on PancakeSwap with 24-hour volumes below $1 In fairness, most price predictions for NLINK through 2025-2050 are posting near-zero valuations, even as percentage growth expectations get closer to growth rates for BTC or alts.

| NLINK Token Metrics | Current Status |

| Current Value | $0.000000 |

| Trading Platform | PancakeSwap |

| 24-Hour Volume | Under $1 |

| Long-term Outlook | Uncertain despite growth projections |

Blink Charging (BLNK): Publicly Traded EV Infrastructure

For those looking for exposure to emerging tech through the public markets, Blink Charging (BLNK) is an actual trading opportunity with ties to sustainable tech trends.

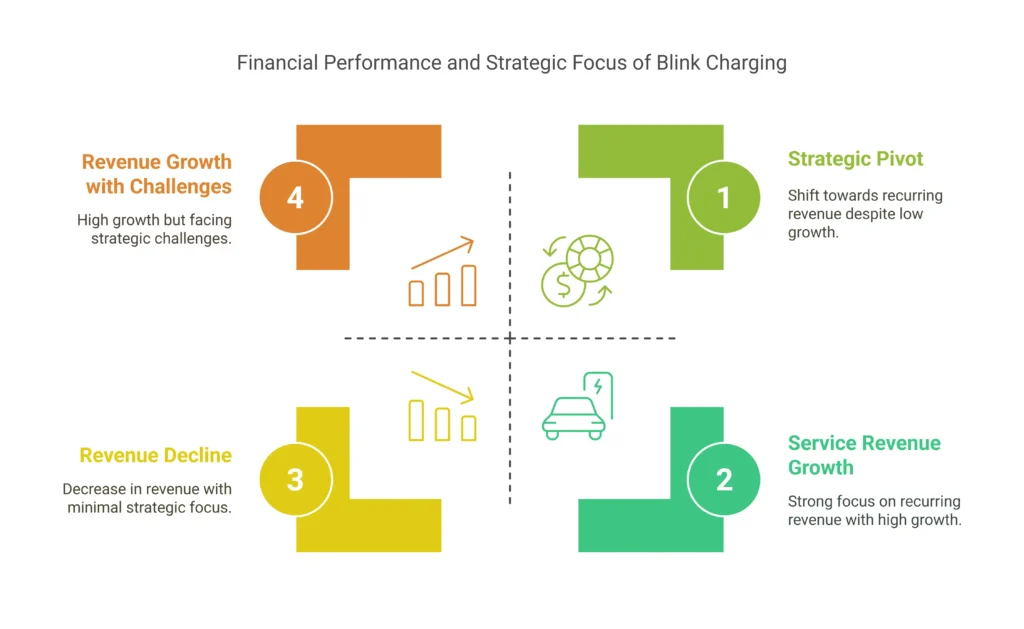

A potential long-term player in the EV space is Blink Charging (NASDAQ: BLNK), which displayed impressive revenue growth in 2023 with 130% YoY revenue growth. Yet recent performance has been hit or miss:

- Q4 2024 earnings per share $0.15 (marginally better than estimates)

- Revenue of $30.18 million missed expectations of $31.76 million

- Revenue for the full-year 2024 decreased 10.2% to $126.2 million from $140.6 million in 2023

- Service revenue segment rose by 31.8% to $34.8 million, indicating a strategic pivot to higher-margin recurring revenue sources

As of December 31, 2024, Blink maintained cash liquidity of $55 million, including liquid marketable securities, with no cash debt, providing some financial stability as it pursues profitability.

Strategic Positioning in the Tech Sector

Neuralink’s BCI Frontier

Neuralink is at the forefront of neurotechnology, which has the potential to be truly transformative. But “the market for non invasive solutions will develop earlier than the market for invasive solutions such as those being commercialized by Neuralink” IDTechEx said. This implies that markets may take longer to recognize Neuralink’s full potential.

Vertical Integration of Blink Charging

Blink Charging is a player in the EV charging infrastructure supporting the shift to sustainable mobility. In 2022, the company acquired the company SemaConnect, an important strategic step: The only vertically integrated EV charging company from research and development to eventuated operation.

The deal added close to 13,000 EV chargers to Blink’s network and nearly doubled its engineering team, improving its competitive standing in the EV charging sector.

The vertical integration strategy also aligns Blink with the Biden Administration’s Buy America initiatives, potentially positioning it favorably for government infrastructure spending with access to the administration’s $7.5 billion investment in national EV charging infrastructure.

Industry Tailwinds and Growth Potential

Both sectors, EV Charging Infrastructure and Neurotechnology, have substantial macroeconomic and policy tailwinds. Government funding into sustainable infrastructure offers huge support for companies such as Blink Charging.

Interest in exploring neural interfaces and BCIs is on the rise, which bodes well for Neuralink’s long-term growth prospects, even if growth is only available to venture capital and private equity investors at this point.

For Blink Charging, the company’s guidance suggests a measured growth trajectory:

- Service revenue expected to continue increasing throughout 2025

- Product revenue stabilizing before improving in the latter half of the year

- Focus on achieving profitability while expanding globally

| Company | Sector | Investment Access | Growth Timeline |

| Neuralink | Brain-Computer Interfaces | Private Only | Long-term (5-10+ years) |

| NLINK Token | Cryptocurrency | Public (High Risk) | Uncertain |

| Blink Charging (BLNK) | EV Infrastructure | Public Stock | Short to Medium-term |

Retail Investor Trends and Considerations

Retails Investors had another profitable year in 2024 by focusing on large-cap tech winners, according to Yahoo Finance Retail portfolios gained around 40.74% in 2024, which was the second-best performance since 2014.

The top six corporate tickets drawing the most retail investor inflows were dominated by major names in tech: AMD, NVDA, Apple and Amazon. This indicates that retail investors are still very much active in the tech sector, but are focused mainly on the larger leaders and not the emerging contenders.

Key Investment Considerations

These potential investors in this space should think through a few major questions:

- Does Blink Charging have what it takes to make the leap to profitability while further establishing a competitive edge in the rapidly growing EV charging sector?

- If Neuralink stays private, what could public investment opportunities look like to access the neurotechnology advancement?

- How will increased EV adoption rates affect charging infrastructure demand, and how well-positioned is Blink to capitalize on this growth?

- What will be the impact of developing cryptocurrency regulations on tokens like NLINK, especially those with low current valuations?

Conclusion

P-word Formation — Distinction between three Nlink names but their investment characteristics are completely different

While there’s much anticipated about what this could mean for the BCI sector, for investors looking to capitalize on this burgeoning field, they may need to bide their time, as Neuralink remains private. If you are looking for a more traditional public market investment, you could also take a closer look at Blink Charging, which is your public market sustainable infrastructure play with some caveats on volatility, but is also a synthetic investment in the future travel and clean energy economy.

Understanding these distinctions is crucial for making informed investment decisions aligned with your risk tolerance, timeline, and desired exposure to various technology segments. As with any investment, thorough research and possibly consultation with a financial advisor are recommended before committing capital.

Neuralink a neurotechnology company founded in 2016, it focuses on developing implantable brain–machine interfaces (BMIs). It was founded in 2016 by Elon Musk. The company specializes in manufacturing electronics for sophisticated brain–computer interfaces (BCIs), revealing targeted applications on the neurological side at first, and a later goal of establishing such a union between human intelligence and artificial intelligence.

No, retail investors are unable to purchase Neuralink stock. This means that retail investors cannot invest directly in the stock since the company is still privately held. Hafi said interested investors would have to wait for a possible future public offering to gain direct investment exposure.

NLINK is a cryptocurrency token that runs on the Binance Coin blockchain. What does it mean for that to have such low valuation metrics (It is around $0.000000 right now) and very low trading volumes (less than $1 in 24h volume on PancakeSwap)? Yet most target prices for NLINK all show low zero-value projections despite sometimes percentage gain projections through 2025-2050

Common mistaken identities like “Nlink” vs Blink Charging (BLNK) Blink Charging, a publicly traded company, develops and sells EV chargers.Unlike Neuralink, Blink Charging offers public market exposure to sustainable technology trends through its stock (BLNK).

The global market value of brain-computer interface can exceed US$1.6 billion in 2045, according to IDTechEx research. Some researchers have noted that the market for non-invasive BCI solutions will develop much more quickly than the brain implants we’re likely to see from companies like Neuralink, meaning it could take much longer to serve the entirety of Neuralink’s potential market.

We have yet to see a clear path to profitability as Blink Charging has struggled to maintain growth over the last quarters. E/LT/aL/Q4 2024 results had earnings per share at $0.15 (better than announced) but revenue at $30.18 million came below estimates at $31.76 million. For the full year 2024 revenue fell 10.2% to $126.2 million for the full year 2024 compared with $140.6 million in 2023. On the bright side, service revenue advanced 31.8% to $34.8 million, implying a shift towards more lucrative subscription-based models.

Pingback: Nlink Stock Analysis: Growth Potential and Risks - 2025 Cybersecurity And Threat Intelligence

Hi there! I could have sworn I’ve been to this site before but after reading through some of the post I realized it’s new to me. Anyways, I’m definitely happy I found it and I’ll be book-marking and checking back often!

I like what you guys are up also. Such intelligent work and reporting! Keep up the superb works guys I’ve incorporated you guys to my blogroll. I think it will improve the value of my site 🙂

I have been checking out some of your posts and it’s pretty clever stuff. I will make sure to bookmark your blog.